$9.1-Million Basquiat Leads Subdued Sale at Christies in London

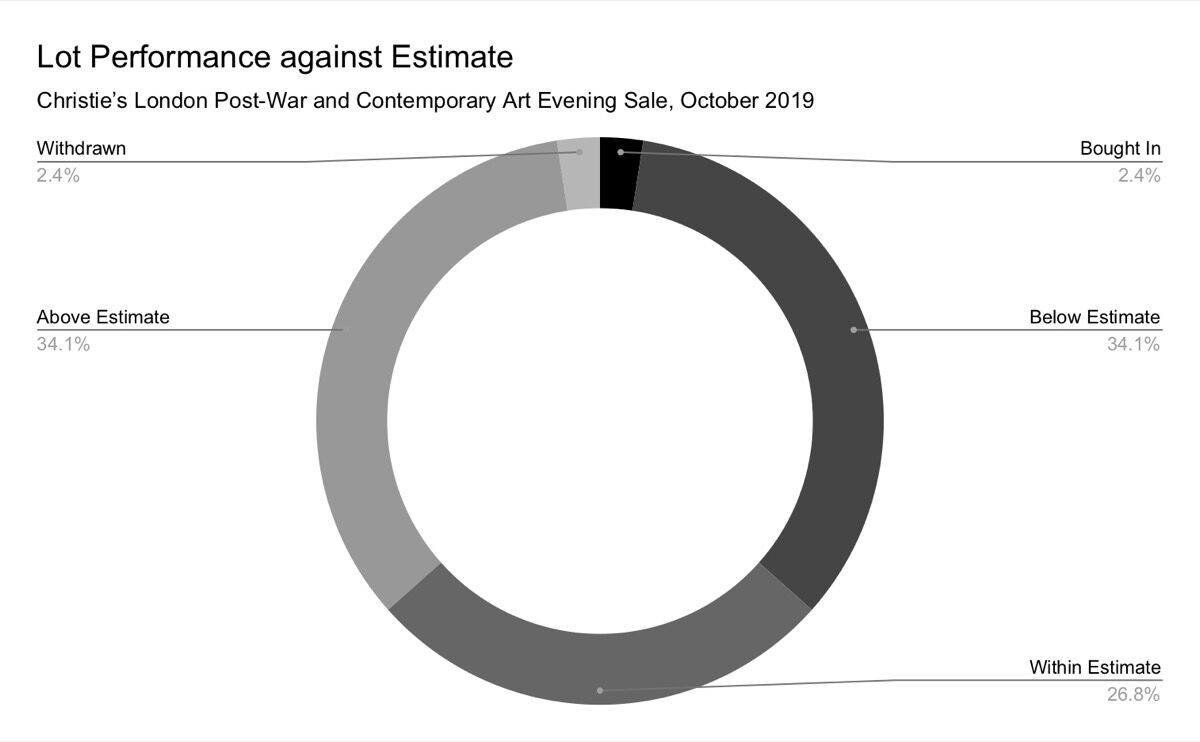

artsy_Christie’s capped the Frieze Week evening auctions of contemporary art in London on Friday with a muted sale at its King Street headquarters. The auction was led by works from three major market forces that all underperformed against their estimates. The Christie’s sale brought in a total hammer price of £54 million ($66.5 million), falling well short of the high estimate of £79 million ($97.4 million). With fees, the sale’s total was £64.5 million ($79.5 million).

Factoring in the “Thinking Italian” sale that immediately followed tonight’s Post-War and Contemporary Art sale, the evening’s total was £89 million ($109.7 million), up from the £84.6 million ($109.4 million) total achieved by the same sale last year. Of the 48 lots in Friday night’s Post-War and Contemporary Art sale, one was withdrawn and six failed to sell. The result meant a sell-through rate of 87 percent by lot, which was up on last year’s sale by 2 percent.

Top lots

- Jean-Michel Basquiat’s Four Big (1982), a large and colorful composition spanning three joined canvases, inspired a short-lived bidding war between a phone bidder and a bidder in the second row of the salesroom. Ultimately, the man in the second row prevailed with a bid of £7.4 million ($9.1 million), just short of the pre-sale low estimate of £7.5 million ($9.2 million). With fees, the price came to £8.6 million ($10.6 million).

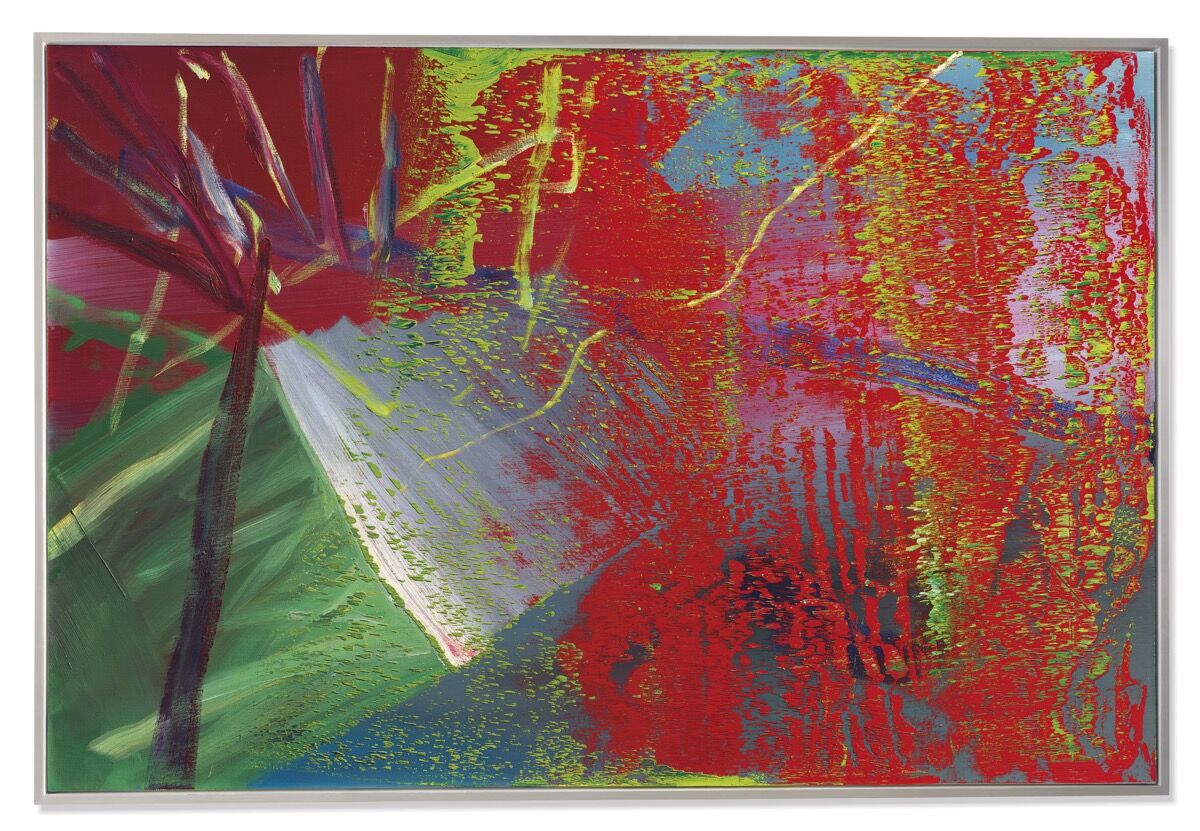

Gerhard Richter, Abstraktes Bild, 1984. Courtesy of Christie's.

- Gerhard Richter’s Abstraktes Bild (1984), one of his large squeegee paintings, failed to reach its low estimate of £6.5 million ($8 million), hammering down at £6 million ($7.4 million). With fees, the price came to £7 million ($8.6 million). While that price fell short of expectations, it was not as dire as the equivalent sale last year, when a Richter painting of a skull failed to reach its reserve price of £12 million ($15 million) and went unsold.

- Sigmar Polke’s Alpenveilchen/Flowers (1967) elicited bidding from the phone banks as well as the salesroom. The large floral painting featuring Ben-Day dots in pastel hues ultimately sold to a phone bidder for a hammer price of £4.8 million ($5.9 million), short of its pre-sale low estimate of £5 million ($6.1 million). With fees, the price came out to £5.6 million ($6.9 million).

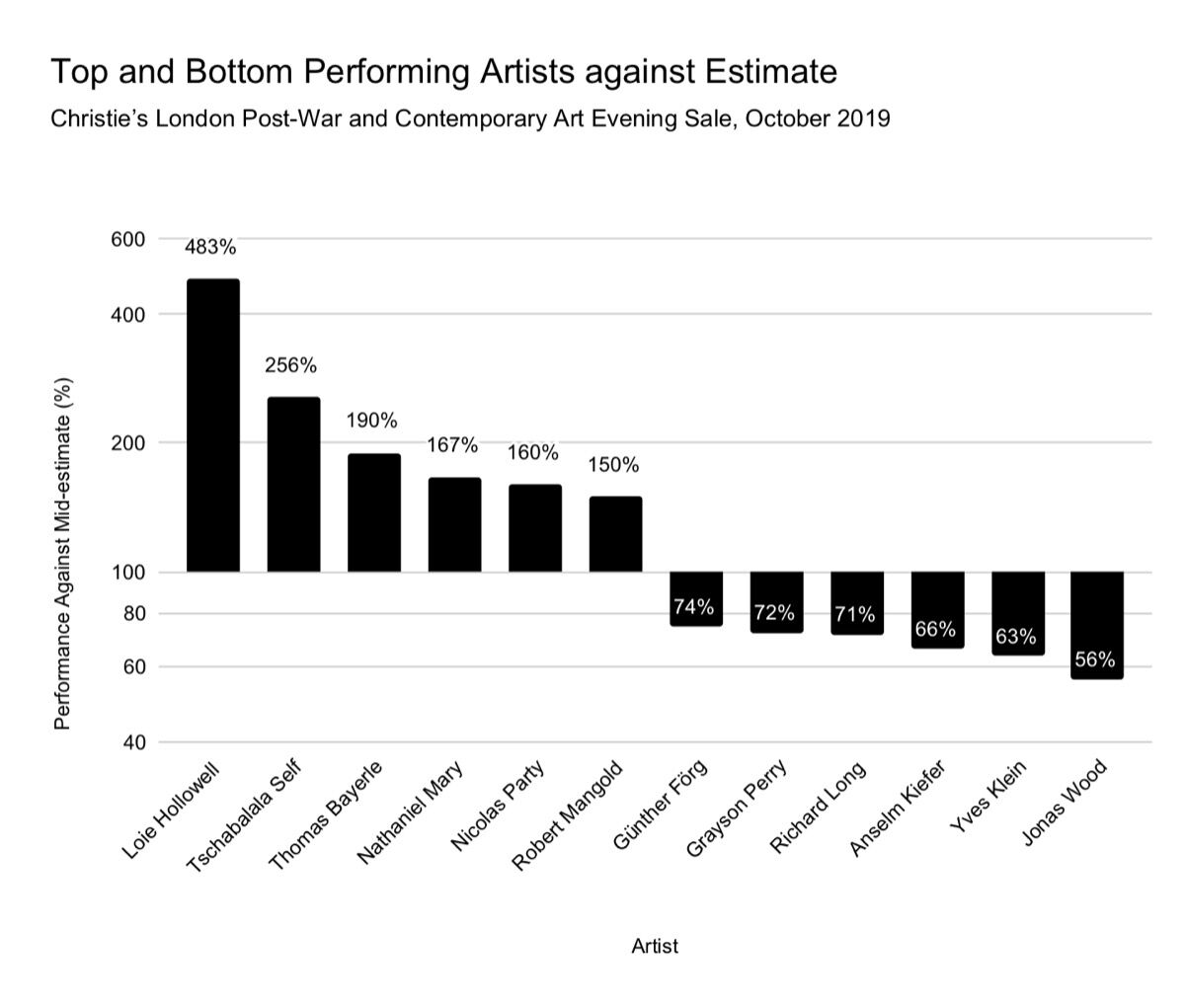

While major painters produced very mixed results, works by a younger generation of artists inspired much more spirited bidding. Works by young market sensations Loie Hollowell

and Tschabalala Self

proved especially popular.

Hollowell’s elegant abstraction Lady in Green (2014) quickly surpassed its high estimate of £70,000 ($86,000) and, after a duel between phone bidders, sold to a buyer on the line with Christie’s Director and Senior Client Advisor Wei-Ting Jud for a hammer price of £290,000 ($357,000), or £359,000 ($442,000) with fees. The sale’s next lot, Self’s large mixed media work on canvas Sapphire (2015), sparked a frenzied bidding war between buyers in the room and on the phones, quickly pushing it past its high estimate of £150,000 ($185,000). The winning bid, placed by a woman seated at the back of the packed salesroom, was £320,000 ($394,000), which with fees came out to £395,000 ($487,000).

Not all young-ish market sensations continued their hot streaks. A large Jonas Wood

painting of a room hung with abstract canvases, Hammer 5 (2010), stalled well short of its low estimate of £1 million ($1.2 million), selling for a hammer price of £700,000 ($863,000), or £800,000 ($986,000) with fees.

The sale set a new auction record for one artist, Minimalist

sculptor Carl Andre

. His piece Copper-Steel Alloy Square (1969), passed its pre-sale high estimate of £1.8 million ($2.2 million) to sell for a hammer price of £2 million ($2.4 million), or £2.4 million ($2.9 million) with fees.

Takeaway

The current weakness of the British pound made Friday evening’s auction an exceptionally international affair, with bidders from 46 countries participating. After the sale, Christie’s expert Alex Rotter acknowledged the exchange rate’s benefits for foreign buyers, echoing comments made by Phillips CEO Edward Dolman on Wednesday evening.

“The currency exchange is definitely a factor and something we use when we’re advising our clients,” Rotter said after the sale.

Friday night’s evening sale of post-war and contemporary art at Christie’s was not a resounding success—the ensuing sale of Italian modernist works performed much better against expectations. But the sale did well enough to echo the sentiment expressed again and again across London this week: The art market is doing just fine. There has been plenty of hand-wringing over the implications of Brexit and the U.S.–China trade war, among plenty of other global crises, but the sales this week at Phillips, Sotheby’s, and Christie’s seem to mirror the swift sales happening at the Frieze fairs.

“Everyone was looking with trepidation at the London sales this week, especially as they mark the beginning of the auction calendar,” auctioneer Jussi Pylkkänen said at a post-sale press conference. “Obviously with the issues going on in the U.K., in Hong Kong, and around the world, there’s a sense of, ‘where are we headed?’ But in the art world, it’s been business as usual.”

The Frieze Week sales conclude on Saturday with Christie’s day auction of contemporary art.